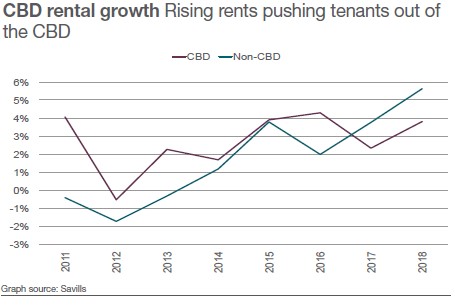

The continued fall in unemployment across Europe is leading to strong office demand and forcing tenants to look to non-Central Business District (CBD) locations, according to international real estate advisor Savills. Prime CBD rents are now on average 4% higher year-on-year (yoy) and 2% above the 2007-2010 rental peak, according to Savills latest European Office Market report for Q1 2018. The lack of affordable good quality space has pushed tenants into non-CBD locations where rents are still on average 70% lower than in CBDs, but are now rising 5.6% yoy and are currently 8% above the five-year average.

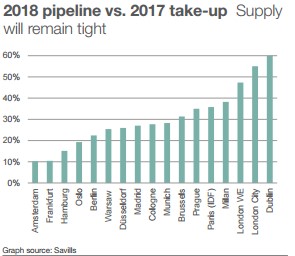

Lydia Brissy, Director, European Research, Savills, says: “Across Europe, we are seeing that the volume of new space being delivered is not enough to meet current demand, so tenants are looking at another two years of supply shortage. Limited supply and rising rents have resulted in occupiers becoming more flexible in their demands; tenants are more willing to move from their preferred location within the core for a better building and cheaper rent in secondary locations.”

Robbie Stewart, Associate Director, Tenant Representation, Savills, adds: “Strong polarisation remains across Europe, with markets such as Manchester, Vienna and Paris CBD experiencing exceptionally strong annual take-up increases of 110%, 69% and 49% respectively. These markets are also seeing the quarterly take-up exceed the five-year average. On the other end of the spectrum, Amsterdam, Brussels and Paris La Defense saw annual take-up levels fall 74%, 19% and 23% respectively.”

Few markets have a vacancy rate above 10.0% and just under one third of the markets are seeing the vacancy rate fall below 5.0%. Savills expects supply will continue to remain tight until 2020 at the earliest. The average vacancy rate will continue to fall to below 6.2%, led by a continued squeeze in the German markets and Sweden. More tenants will turn to serviced office providers for prime space and vacant space will be found in older office stock in secondary locations.

Highlights of the Bucharest Office Market in Q1 2018

Currently, the Bucharest office market is a landlord’s market, mainly because of the low vacancy rates. As a result of the delivery of new office projects, along with clients’ various requirements (the need for all-in-one workspaces, with retail facilities, entertainment and fitness/wellness areas), the market will likely shift towards a tenant’s market.

In the first half of 2018, the space dedicated to co-working has almost doubled in size in Romania, from 33,000 sq m in October of last year, to 61,000 sq m in June this year. The main market is Bucharest, but areas like Moldova have seen a major development in co-working spaces lately. The trend will most certainly continue, as startups are more and more common and the newer generations, especially generation Y, prefer freelancing activities to traditional 9 to 6 jobs.

Simona Urse, Associate Director Office Agency at Crosspoint Real Estate, a service delivery partner of Savills, comments: “The rents in the peripheral areas are not affected by the low vacancy and high demand for CBD spaces. Prime headline rents remain unchanged (EUR 18 – 19 EUR per sq m/month) but are expected to increase this year, as the vacancy rate for these areas is at a very low level. Landlords are offering incentives such as rent-free periods and fit-out budgets, thus net effective rents are ca. 10% – 15% lower than headline rents. However, the low vacancy rate will cause a decrease in incentives.”

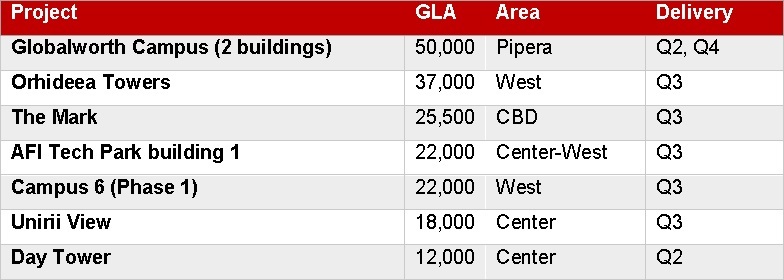

The vacancy rate in Bucharest registered a decrease in 2017 reaching 8.5% (which translates into 233,750 sq m of office space ready to be leased). In Q1 2018, the vacancy rate remained roughly the same, as no new deliveries were made. However, we expect the vacancy rate to rise by 2%-3% by the end of the year, when over seven new projects will have been delivered on the Bucharest market.

Pipeline:

In total, almost 200,000 sq m will be added this year to Bucharest’s total office stock which was expected to reach 3 mil. sq m by YE 2018. However, the postponed delivery of three buildings with a total GLA of over 65,000 sq m means that the 3 mil. sq m mark will be reached in early 2019

For further information, please contact:

Lydia Brissy

European Research, Savills

Tel: +33 (0) 1 44 51 73 88

Eri Mitsostergiou

European Research, Savills

Tel: +40 (0) 728 205 626

Robbie Stewart

Tenant Representation, Savills

Tel: +44 (0) 207 758 3874

Kai Störmer

European PR Manager, Savills

Tel: +44 (0) 207 075 2885

See the news published in

Wall-street.ro

Constructiv

Agenda Constructiilor

Profit.ro

Saptamana Financiara

Business Review