During the first half of the year, the total investment volume in Europe reached more than €97bn. Although this is 5% down on the last H1 turnover, it remains 42% up on the average past 10-year H1s, according to international real estate advisor Savills. The Netherlands and Poland particularly stand out, recording an annual increase of investment activity of 176% and 100% respectively, followed by Ireland (94%) and Portugal (35%).

The share of core markets remains unchanged, still accounting for 65% of the total volume. While H1 2018 investment volumes are slightly down compared to last year in both the UK (-9%) and Germany (-7%), they are up by 27% in France compared to a sluggish first half of 2017 due to the presidential elections. Urban and infrastructure developments for the Grand Paris project and the 2024 Olympic Games and an improved political landscape are positive signs that are attracting investors to France and more particularly the Paris region.

Demand for office investments remains high, supported by strong fundamentals: Office vacancy rates remain extremely low in all major European cities and development activity is still insufficient to meet demand. While prime CBD office yields are showing signs of stabilisation, secondary CBD office yields and prime non-CBD office yields remain under strong downward pressure. On average across Europe, they moved in by 22bps and 31bps respectively, resulting in a narrowing of yield gaps. The average prime non-CBD office yield currently stands at 4.9%, below the average secondary CBD office yields which is at 5%, reflecting strong investor appetite for prime assets, also outside the CBD.

Europe is still attracting foreign capital, which accounted for half of the total volume, in line with the 5-year average. However, overall cross-border inflows mainly came from European countries during the first half of this year, whereas both U.S. and Asian investments in European property decreased compared to last year. U.S. capital is progressively cycling out of opportunistic strategies to focus on core/ core plus opportunities. The decrease of Asian inflows is mainly due to the Chinese government’s restriction on outbound investments, whilst interest from Korean and Singapore investors in particular is continuing.

Offices will continue to be the preferred European asset class over the next 12 months, although investors’ appetite for alternative assets and logistics will continue to rise, according to Savills.

Marcus Lemli, head of Savills European investment, says: “We are seeing market dynamics in Europe slowing down but at the same time the fundamentals remain positive, despite political risks. Therefore we believe the current cycle could continue for quite some time. Interest from international and domestic investors in European real estate remains high and we expect the commercial investment volumes for 2018 to be broadly in line with last year.”

Lydia Brissy, director in Savills research team, adds: “Most investors in Europe are still seeking secure assets in prime locations across all sectors, but they are increasingly forced to move up the risk curve. As logistics is becoming an integral component of a successful multi-channel retail strategy, demand for logistic assets is growing, whilst investors restrain their exposure to the traditional retail sector, to ultra-prime locations let to strong covenants.”

Codrin Matei, Managing Partner, Head of Office Agency, Capital Markets & Business development at Crosspoint Real Estate in Romania adds: “The investment market continues to confirm last year’s trend in relation to the transaction volume, but especially with regards to the diversification of the types of investors present on the market. The South-African capital is intensifying its presence through new acquisitions; thus, Romania’s image gets a vote of confidence from new investors who come from this area.”

The investment market in Romania H1 2018

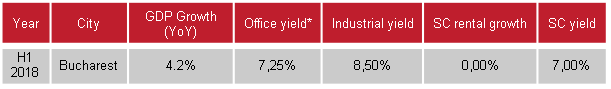

2018 is expected to attract at least the same volume of investments as the previous year. Even if the economic growth has stalled in the first quarter, IMF expects a 5.1% GDP growth for Romania in 2018. The unemployment rate is also on a descending trend, from 5.2% last year to 4.6% this year.

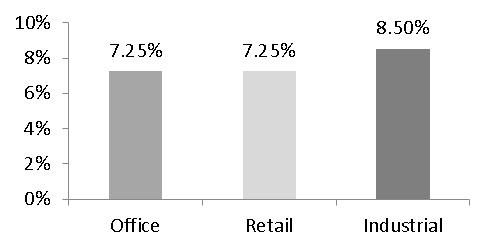

Prime yields have remained roughly the same as 2017, with the prime office yield dropping by 0.25% while retail yields have slightly gone up by 0.25%.

With an increasing amount of products available on the market, especially in the office segment, a few transactions pending from last year and a growing interest from new international investors, 2018 is likely to continue the progression we have noticed in the previous two years.

Prime yield outlook H1 2018

Source: Crosspoint Real Estate Research

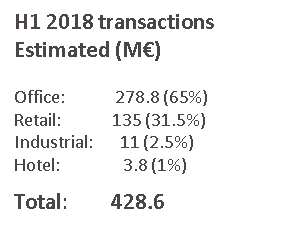

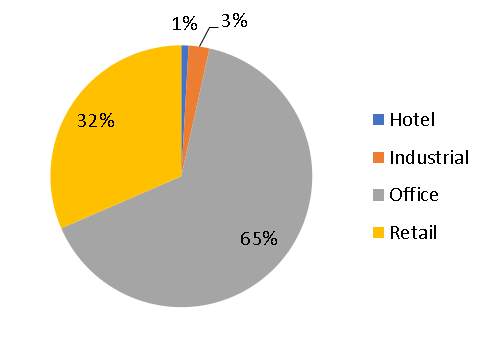

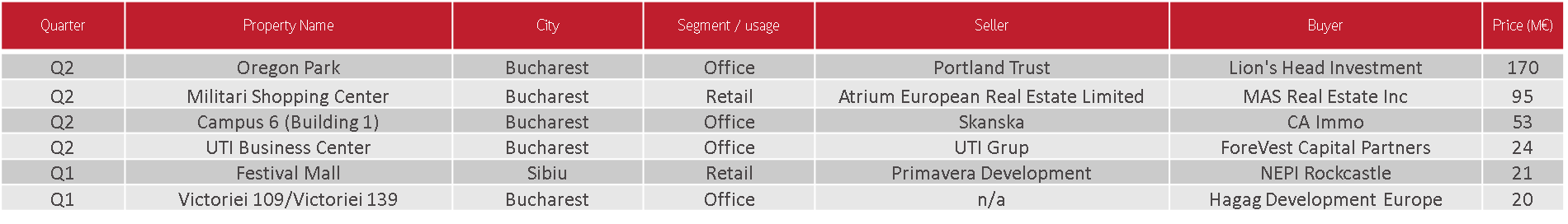

With a slow start in Q1, the Romanian investment market has recorded a significant volume of transactions in the second quarter, which balanced the total value of deals for the first half of 2018. Although 20% lower than that of H1 2017, the transaction level reached about 428 M EUR, with 384 M EUR transacted in Q2.

Investors in the office segment have been the most active, the volume of office transactions having a 65% share in the total value of transactions. The largest office transaction (170 M EUR) was the sale of the Oregon Park office complex in Bucharest to Lion’s Head Investment, a fund with South African source of capital and a newcomer to the Romanian investment market.

With a 32% share of the total investment activity, the retail sector registered a large transaction in Bucharest, where Militari Shopping Center was sold for 95 M EUR to another large South African investor, MAS RE. The other two cities where a few smaller retail products attracted investors were Sibiu and Brasov.

Due to a lack of new products, only one significant deal was concluded on the industrial market, in Brasov, where WDP acquired a 20,000 sq m industrial project for 11 M EUR.

Top investment transactions Romania H1 2018

Source: Crosspoint Real Estate Research

Source: Crosspoint Real Estate Research

Forecast:

With pending deals worth over 300 M EUR and new products expected to become available on the market, the second half of 2018 will register a sustained investment activity.

An aspect we have already observed in the first half and which will most likely continue throughout 2018 is that new actors are entering the Romanian market, encouraged by the good results of established investors. Another change might come with the increasing interest of some national players who have been testing the market in the past few years. Dominated by foreign investors, especially South African funds, Romania has been the entry point for South African institutions looking to expand their portfolios into CEE. Romania’s investment market records the highest level of investment yields in Europe (7.25 – 7.5% ). Taking into account the relatively good economic outlook we expect an increased interest from foreign investors and potentially a yield compression.

By the end of the year, the investment volume will probably reach last year’s 1 B EUR mark. Office buildings will continue to be the most sought-after products. Along with the delivery of new industrial projects and the existing players’ surging need for expansion there is a big chance a few large transactions will be registered in this segment in 2018. The retail investment activity will most likely concentrate on small projects present on secondary markets. Bucharest will remain the top destination for investors, because of the accessibility of the most attractive products, the availability of highly qualified workforce and the presence of the most successful economic operators in the country.

Main drivers of growth:

Growth propelled by domestic demand

A healthy growth of personal consumption is also reflected in the data on real retail turnover and growing consumer optimism. Consumer confidence, consumer expectations and consumer sentiment index neared the levels before the recession. The more positive outlook of households is based on two key factors: significant income growth (growth of the minimum income, growth in public employees’ salaries, pension growth) and in the availability of record low interest credit rates.

Romania’s overall tax burden is comparatively low

The new Fiscal Code and Fiscal Procedure Code, which came into force on 1 January 2016, introduced several incentives for companies and individual investors, combined with a reduction of the standard VAT rate. Another batch of incentives projected for this year should help further accelerate growth and increase investment. Nearly 70% of Romanian CFO’s stress that the tax changes should positively affect their business.

The level of education remains one of Romania’s strengths, especially in terms of language proficiency and sciences

The cost-effective but talented labor force is a factor attracting outsourcing centers. The business services sector is helping drive the country’s economy. Nine Romanian cities are among the TOP 15 Cities with the highest download speed in the world.

For further information, please contact:

Lydia Brissy

Savills research

Tel: +33 1 44 51 73 88

Marcus Lemli

Savills investment

Tel: +49 69 273 000 11

Natalie Moorse

Savills press office

Tel: +44 (0) 20 7075 2827